por noel | Sin categoría |

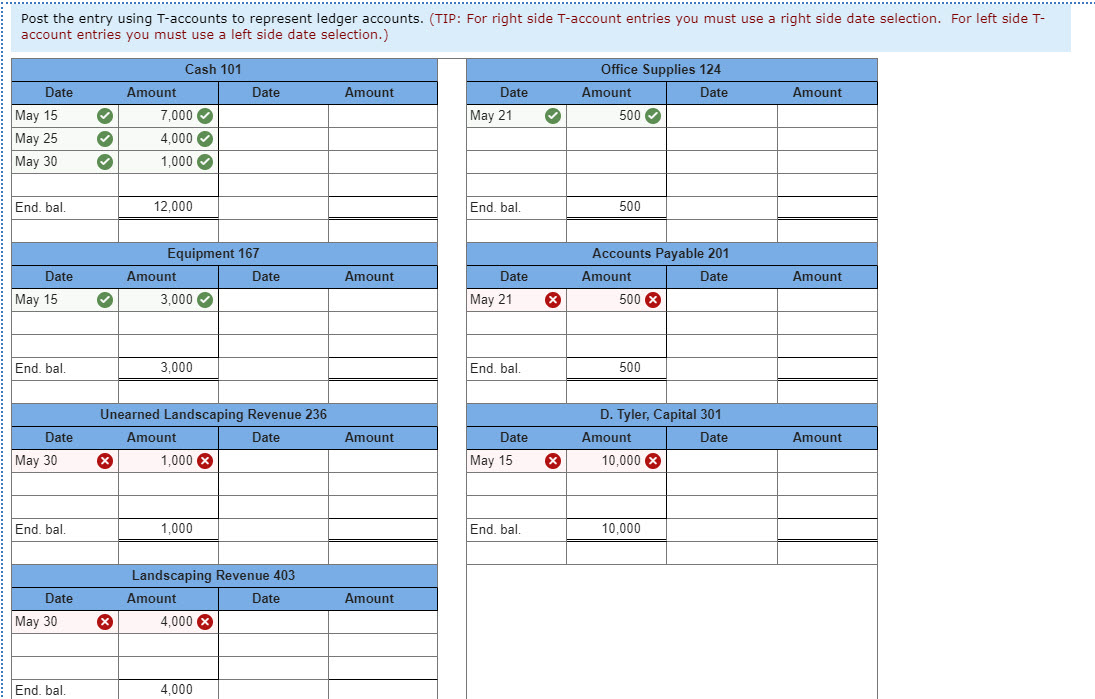

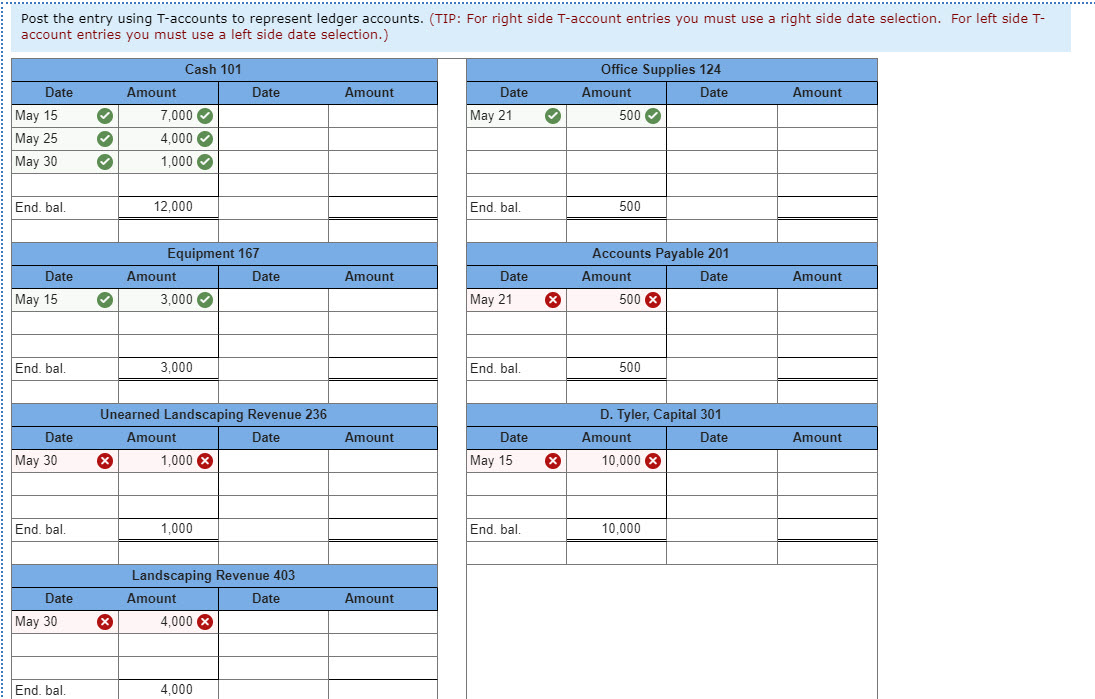

Individual Student loan App & Underwriting Processes

Underwriting an educatonal loan is a bit different than other forms out of obligations. Having individual financing, you still need to go through an acceptance procedure, but with federal financing there are shorter strict standards.

Many otherwise all enterprises checked bring compensation so you can LendEDU. These commissions is exactly how we take care of our 100 % free service for consumerspensation, and hours away from into the-depth editorial lookup, find in which & how people show up on our very own web site.

Into the cost of tuition expanding on a yearly basis regarding United States, more people finish playing with student loans so you can help afford the will cost you.

You can search getting scholarships and grants and save up around possible, you can still features a financing pit. That’s where trying to get student loans come in.

Having individual student education loans, regardless of if, there’s a keen underwriting techniques. (más…)

por noel | Sin categoría |

To the Home loan Finance ranked Liberty Financial as the most readily useful Va financial and FHA lender on the You

Liberty Home loan also provides different purchase and you will refinance funds, and you will intends to look for you the reasonable interest you can.

Our objective will be to supply the systems and you will rely on your need to alter your earnings installment loans in Birmingham Ohio. While we located compensation from our mate lenders, who we are going to usually choose, all feedback try our own. Credible Procedures, Inc. NMLS # 1681276, was regarded here because the «Reliable.»

Independence Financial are a family group-owned mortgage lender with well over three decades of experience providing users buy and you will refinance their homes.

Before you apply for a loan with Liberty, look at this Independence Mortgage feedback discover a become to have the various brand of financial services level of services the latest company provides.

Freedom Home loan actually a spouse lenders. But you can fool around with Legitimate examine financial prices from other mortgage lenders in a matter of minutes.

Versatility Home loan feedback

- Borrowers who want to find the lower rate you can

- Consumers trying be eligible for Virtual assistant or FHA resource

- Consumers that have previous borrowing issues and you can/or smaller income

Independence Financial also offers a standard gang of financial buy funds, including traditional mortgages and regulators-recognized home loans. (más…)

por noel | Sin categoría |

This is important for anyone having trouble being qualified for a good Virtual assistant financial

5. Pros First mortgage

Experts First-mortgage is another of the premier Va mortgage brokers in the united states but this financial has the benefit of FHA mortgage loans.

FHA finance, such as for instance Virtual assistant funds, have more everyday credit requirements. Your debt-to-income ratio won’t have to feel better-notch. Your credit rating are into the all the way down front. And you also you will definitely however get affordable home loan repayments.

Non-pros and you can veterans similar is be eligible for a keen FHA mortgage. However, if you are an experienced or an active obligation services member, there’s no battle: Loans through the Agencies off Experts Products have more advantageous loan terms and conditions for example making no downpayment and you can qualifying with no credit rating.

Veterans First mortgage has the benefit of a myriad of Va lenders, along with repaired-rate, adjustable-rates, and you will Jumbo financing. (más…)

por noel | Sin categoría |

A. 1445, 1446 and you can 1449 about the question of went on lives away from Domestic Financing Banks

Process of law may well not continue to be indifferent for the visibility of this type of plenary manage created because of the Congress – an effective «life-and-death» kind of manage and therefore Congress provides seen complement to keep up instead of people material changes since regarding the newest Work during the 1932.

Additionally, people do not wade thoughtlessly towards such Home loan Bank ventures – it guess the personal debt with all of the legislative and you will administrative «strings» affixed when a constitution was granted in it by Board

New administrative manage process ergo set-up by Congress are a great essential adjunct of banking system, by implementing they Congress charted a span of company conduct for those financial institutions hence are the latest handling push in their existence. (más…)

por noel | Sin categoría |

With this pointers, their bank could probably prequalify your to have home financing from a certain amount

The likelihood is convenient to make contact with a number of lenders at this phase and have prequalified. You’ll be able to to compare financing has the benefit of and find the new one that provides you with a knowledgeable rate and you may terminology.

The brand new Groups Very first program possesses its own range of using loan providers, and also the first rung on the ladder within the obtaining this new down payment give is to try to contact one of them loan providers.

Step 2: Come across a house

That have a good prequalification available, you will be aware the price selection of our home you need to be selecting. You can also believe employing an agent who can help you notice the right home and make suggestions from process of creating an offer.

Step three: Sign up for the loan

After you have a purchase contract in your future new home, you could potentially over a complete application for the loan into the lender you chosen. (más…)

por noel | Sin categoría |

Federal figuratively speaking also are maybe not <a rel="nofollow" href="https://clickcashadvance.com/installment-loans-nd/portland/">http://clickcashadvance.com/installment-loans-nd/portland/</a> dischargeable in the bankruptcy proceeding, reducing the alternatives regarding consumers when you look at the financial distress

A. Organization Background

Figuratively speaking is actually a popular method for People in america to blow the brand new cost of university, while the access to such as financing could have been growing into the previous age. Within the 2005, 30% out of twenty-two-year-olds had collected particular education loan financial obligation, that have the typical genuine equilibrium among debt people of approximately $13,100. By 2014, such numbers had risen to forty five% and you can $sixteen,100000, respectively. 5

Most of the children gain access to federal college loans, which usually dont include underwriting and certainly will costs lower than-ount of such money youngsters can obtain try capped from the Congress, not. Beginner borrowers frequently fatigue their available federal financing ahead of shifting to help you fundamentally higher priced individual financing, usually which have a daddy due to the fact cosigner. Typically, the common education loan is totally amortizing more a good ten-season identity with repaired repayments. Deferments and you will forbearances can continue it name, as well as enrollment in the alternative installment agreements, for instance the lengthened payment plan (designed for borrowers with a high stability) and you may money-passionate cost arrangements (having be more prominent recently and tend to be readily available getting individuals which have increased obligations-to-money percentages), and you can due to mortgage combination. (más…)