For people who have not attained the fresh new closure big date of your own latest family once we should pick an alternate that, a link financial makes you use the equity out of your established where you can find pay the down payment in your second household.

Thought you have just located your ideal house, right after which miraculously, you even be able to victory the new red-hot putting in a bid battle in order to purchase it. Problems are, you will be nonetheless looking forward to the new marketing on your current the home of intimate, so money is rigid. In which would you get the down-payment so fast?

Link investment can help convenience brand new change ranging from promoting the dated family and buying a different you to definitely. If you haven’t achieved the latest closure go out of your own newest domestic by the point we wish to get another that, a link home loan allows you to make use of the guarantee from your own established the home of afford the down payment on your own next domestic.

By definition, link capital really helps to reconcile that short pit between your get regarding another type of household as well as the business out of a classic family.

Mortgage loans and connection funding: how come they performs?

Speaking of quick-name finance, generally given that temporary as 90 days to 120 weeks (certain can go so long as annually). New caveat is when he’s prolonged, financial institutions tend to place a lien with the family, that can want a pricy a residential property attorney.

not, because they’re small, you will understand for folks who qualify in just a few days, if not a week – something is not constantly you can with a vintage financing.

A connection financing lasts just long enough so you’re able to release certain guarantee in your dated house – that you then use to afford the link financing, including appeal when it’s eventually marketed. A link financing has to be paid down on the business closure time, claims Turk.

Perform I qualify for connection financing into the Canada?

Very Canadian banks will want to pick both the revenue agreement for your dated home while the purchase agreement to the brand new house just before being qualified you for a connection financing.

Mainly because small-identity finance usually are secure in a few days, of numerous facts enter into being qualified, such as how quickly your property will actually sell, your credit rating, and also the amount of guarantee remaining in their dated house.

To be entitled to home financing link mortgage from inside the Canada, you probably need a credit rating that’s either good to advanced level (650 so you can 900). Financial institutions will also consider carefully your income-to-debt proportion, because they want to be yes you can financially bring one or two mortgages and you may a link financing for a short time.

Usually, the absolute most you might take out to possess a link mortgage is actually 80% of one’s mutual worth of your home plus the brand new domestic.

Preferably, you prefer the link financing so you’re able to period a few days between your purchase along with your profit, which means you have time to set up your property and you may vacate your current assets, states Ron Turk, a home loan mentor at the Scotiabank.

When can it add up to apply for a home loan connection financing?

In a hot housing marketplace, whenever putting in a bid wars all are and you have and then make a beneficial snap decision, a link loan can be take back particular exchangeability so you can get your dream home.

Not only that, connection capital may also help you earn a jump start to your home improvements in your new home before you even relocate. And, maybe to start with, bridging a home loan also can lessen fret.

Or even intimate on the the brand new get before you could submit your selling, might possibly need to intimate each other features on the same day, otherwise vacate very first property before you could are able to enter into your own newly ordered property, states Turk.

Closure a couple features on a single day might be exhausting, very making it possible for a few days among them closings offers time and energy to score what you complete.

What you should realize about connection capital pricing

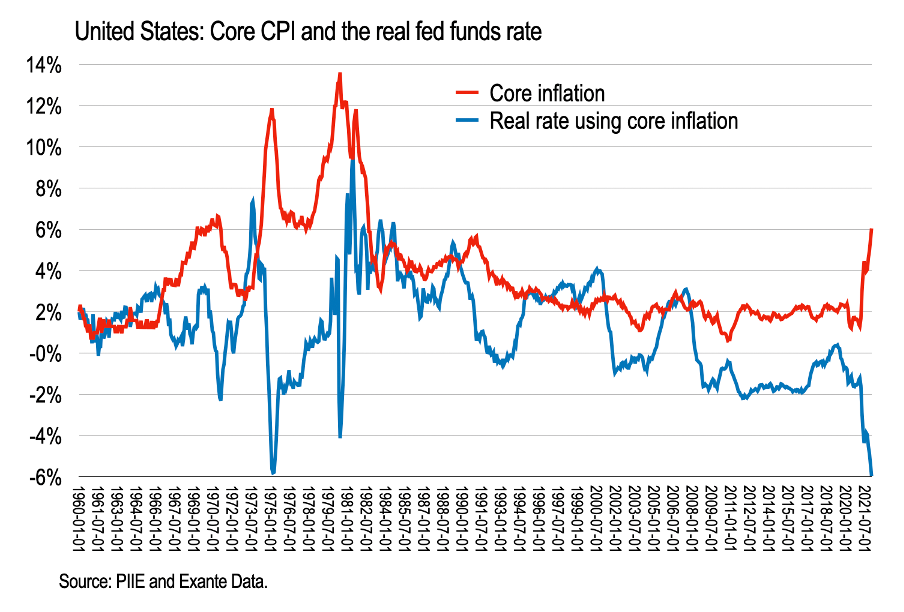

The financial is different, so the requirements and you may costs to possess connection financial support will vary. And because bridge fund are made to stop wasting time, they are often subject to highest interest rates, often the primary speed (a fluctuating otherwise adjustable interest) also two or three%.

The bank may also charges an administration percentage off anywhere between $two hundred and you will $five-hundred. And you may a legal professional can charge a charge when the some extra paperwork is required.

But if you end up from inside the a pinch, it could be worthy of connecting the fresh new gap that https://paydayloanalabama.com/valley/ have home financing. It could simply offer the economic go place you will want to escape their old home and into the brand new one.