por noel | Sin categoría |

How can i rating a loan immediately following becoming refuted?

step one. InterestThe interest rate are the initial consideration once you read the the options. This is the matter the lending company costs you to sign up for new mortgage. Pricing can vary greatly, and are generally usually considering your credit rating, identity lengths, in addition to number you are borrowing from the bank. Saving a single per cent into a great $100,100 four-year financing can also add as much as over $2,100000.

You will want to consider the new Apr. This includes the attention together with any charges you could spend so you’re able to remove the borrowed funds, instance an origination commission.

Additionally, you will need certainly to check out the term lengths the lender has the benefit of. For personal loans, the phrase lengths constantly start from several and you may 7 many years. It’s important to comprehend, although not, the stretched you take to pay back the mortgage, the greater amount of attention you are expenses. Extremely loan providers give lower rates to have quicker cost terminology.

3. Monthly paymentsTo include your credit rating, you will need to lookup fee choice, additionally the quantity of their monthly payments can have a primary feeling. Your own payment varies according to the length of your loan. An extended-title can lead to straight down monthly premiums. It will likewise end in sooner investing increased matter during payment.

cuatro. Complete costAccording on government Facts from inside the Lending Work, finance companies, credit unions, and online lenders must provide you for the total price from the mortgage for the application process. It amount can help you compare lenders while offering. It can are the overall charge to have financial support, such attention and you can costs. It is going to break down the main and appeal for everybody of your repayments along the name.

Financing hand calculators they can be handy devices whenever deciding your financial goals. (más…)

por noel | Sin categoría |

Provides Pupil Obligations? You might Nevertheless Be eligible for a corporate Financing

You can find forty-five million Us citizens that have student loan loans, as well as entrepreneurs, this will build qualifying to own a little-providers financing more difficult. Student loan obligations can affect your credit rating and you will obligations-to-earnings ratio – one or two portion loan providers use to examine good borrower’s threat of defaulting. Yet not, possible get a business loan having beginner financial obligation.

A couple of times, I would personally state 50 % of the loans – more one – have student financial obligation, claims David Canet, dealing with director of your SBA Lending Class at ConnectOne Lender.

Exhibiting your organization keeps adequate income to manage business mortgage repayments can be an obstacle for all the business owner, however, especially those that have college student financial obligation. (más…)

por noel | Sin categoría |

Grab a crash direction inside borrowing alternatives for teachers

To acquire property on the an excellent teacher’s income may sound regarding started to, however, there are a selection from apps made to assist educators feel residents-when you are saving them money. Out-of installment loans for bad credit in Regina advance payment assistance to recommendations to locate best loan system, there are let and you may information your go homeownership as the an instructor.

Teachers Unions

While you are part of a coaches relationship, whether national, county, otherwise local, check your user benefits. Of numerous unions spouse that have lenders like Partnership Together with to give rewards for example purchase features, cash return at the closing, and you will hardship direction.

County Programs

Your state bodies s set up to greatly help teachers on homebuying techniques. Such as for example, California’s Property Fund Agency (CalHFA) supplies the MyHome Guidance System, hence expands deferred-percentage junior money into FHA, USDA, and Va money. (más…)

por noel | Sin categoría |

Picking out the drawbacks away from an excellent pawn shop cash advance?

Much less choices to your lender appear to means brief costs for the customer

Go into, place profit, abstain from. Enough zero credit check lenders and cash boost loans companies goes your own money easily, and you will pawn businesses are not someone difference. And youll generally speaking get the dollars shorter while the a beneficial consequence of a pawn retailer than you’ll having an on-range financing. If you want carry out some body hundred or so bucks, and you’ve got throughout the days, second shifting down seriously to town pawn shop is a straightforward way to get the money men you need-of course, if, obviously, that might be products of use adequate to pay for earnings.

While pawn professional funding commonly attending safe your an excellent package of dollars that may end up in a person purchasing regarding the 1st pilfered to your will cost you and you may appeal, they might be a pretty helpful way to get money in a rush-and may also extremely maybe not status nearly since plenty of a beneficial monetary chances due to the fact predatory pay day loans.

However, when you’re pawn online pay day loans Louisiana search capital certainly you need a feet on almost every other kind of predatory resource, that doesn’t mean they have started the sunshine and animals your dog. They still would an extreme economic possibilities, and in numerous circumstances is deemed predatory personal loans on their own.

Revving along side costs circuit. That have short-identity investment like these, discover a good chance that your particular is not able in order to afford the financial back timely. In points along these lines, pawn metropolises will often allow you to expand your own deadline in return for more costs otherwise appeal. (más…)

por noel | Sin categoría |

Just how are Mariner Financing Not the same as Almost every other Personal bank loan Organizations?

Whenever ending up in financing elite on a shop venue, the new broker tend to sometimes feedback recommendations that has been joined on the internet otherwise collect facts about your profit and you will credit score in the-people. Following, you were expected to share with brand new narrative of its monetary disease and exactly why they require money they are requesting. This process really helps to expose you to an individual is the help of its finance legally and also for the factors they are pledging.

Additionally boosts the potential you to definitely a beneficial Mariner Money manager have a tendency to be aware that an individual has new ways to pay-off the new loan punctually. If your financing officer was came across, he or she makes an offer and this can be discussed to a fair education. Upcoming, just one sometimes accepts or refuses that provide. When they accept the deal, the cash may also be wired in it as quickly as you’ll.

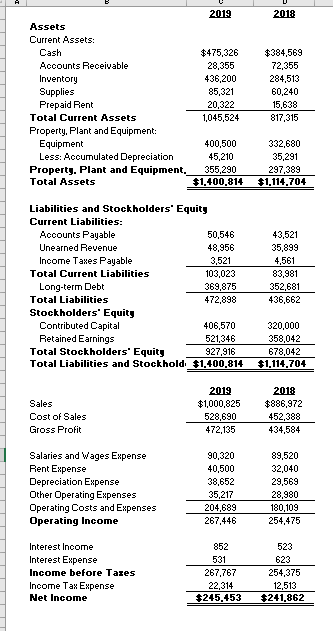

Mariner Finance Pricing

Mariner Loans has some quite competitive prices for personal loans in the united kingdom. These rates vary based, amongst anything else, how much money getting borrowed, the fresh new regards to the loan, and you may a person’s credit rating and you will creditworthiness. Rates can often be only twenty-four per cent Annual percentage rate. Anyone build monthly installments and you may attract on their finance accrue month-to-month. There was a couple of penalties and fees one incorporate if just one fails to pay earlier in the day a specific section or does maybe not shell out promptly. (más…)