For those who have reasonable borrowing from the bank, looking and you may qualifying private mortgage financial support can be done, but you will find what to keep in mind to prevent undesirable financing terms. ( iStock )

A job losses otherwise high priced crisis is wreck havoc on the savings account as well as effect your credit score if you get about in your costs. If you have a smaller-than-primary credit rating, that does not mean you must exclude providing an individual mortgage.

Really loan providers determine borrowers predicated on its FICO credit score, the fundamental. The new selections get into these types of four classes:

- Poor: Lower than 580

- Fair: 580 so you’re able to 669

- Good: 670 to 739

- Pretty good: 740 in order to 799

- Exceptional: 800 and you will above

Lenders consider consumers that have results a lot more than 670 become creditworthy, according to FICO. For those who have reasonable borrowing, you may not see every lender’s qualifications criteria for personal financing, however some organizations work with you. As procedure could be more tricky, your enhance your potential to achieve your goals once you know what you should expect and you may where to search.

Simple tips to submit an application for an unsecured loan

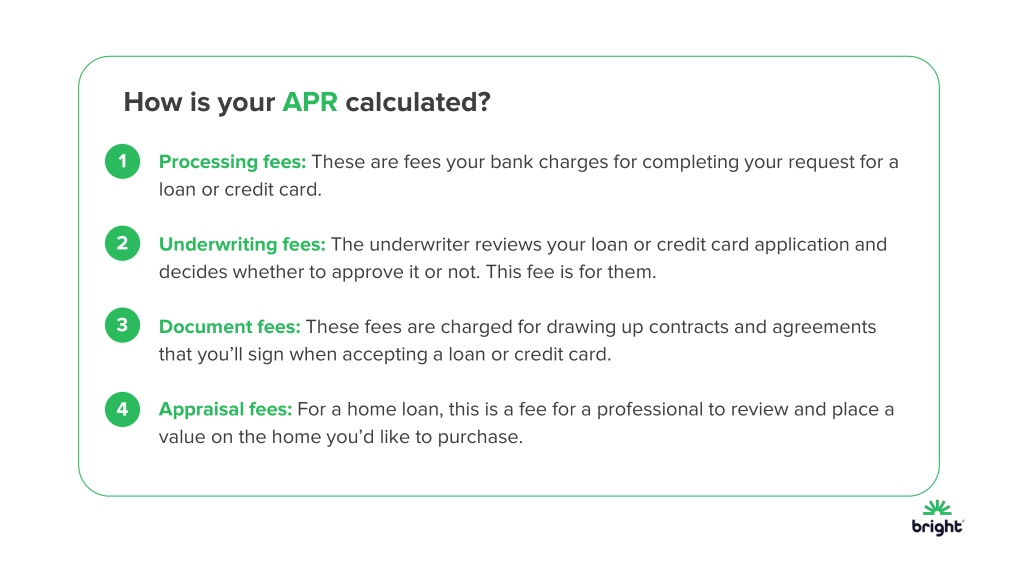

After you submit an application for a personal loan, the financial institution commonly check your credit rating determine just how long you had borrowing from the bank, how much cash borrowing from the bank you already have, exactly how much of your readily available borrowing from the bank is being made use of plus background to have paying the bills promptly. And you will a tiny set of loan providers personal installment loans in Long Beach fool around with a special kind of credit score entitled Ultra FICO, and this products on the reputation of bucks transactions.

If you fall into new fair borrowing from the bank range, you might still feel recognized, but you’ll likely be recharged increased interest. While some borrowers is also qualify for unsecured loans which have annual payment costs as low as 4.99 %, the average rate of interest for personal fund is per cent, with regards to the Federal Set-aside. For those who have reasonable borrowing from the bank, the speed are into the high front. It is possible to getting charged large origination fees.

Before applying to own an unsecured loan, ask if for example the financial usually prequalify your. This step concerns a softer credit assessment, which will not impression your credit score. You won’t want to unknowingly need an activity you to definitely lowers your rating then only to read that you do not meet up with the lender’s standards.

Unsecured loan lenders to own users having reasonable borrowing

Even though you will likely spend even more for a loan when you may have fair credit, you will want to nevertheless shop around to discover the best deal.

Check many lender sizes, such as on the web lenders and regional finance companies and credit unions. Government borrowing from the bank unions, for example, cover interest rates at 18 percentpare the newest terms of the mortgage; when you may get a better speed from 1 lender, another may offer down fees.

How to handle it in the event your application for the loan is declined

If the a lender denies yours application for the loan, remain searching. There is other choices readily available. Carefully envision how fee fits into your budget and do not prefer a lender that have tough terms and conditions. For those who struggle to make the payment, this may adversely impression your credit history going forward.

Make a plan to repair their credit. Look at the report to have wrong recommendations, and you may dispute one discrepancies you will find. With respect to the Government Trading Payment, one out of four people possess an error on their credit history.

Lower financial obligation. Loan providers like to see a financial obligation application ratio-the % out of offered credit that you are currently using-getting around 30 %. And be diligent on using the costs timely.

By firmly taking some actions to evolve your own borrowing, you might establish right up to own best interest rates regarding the upcoming plus one day get in on the 800 credit rating group.