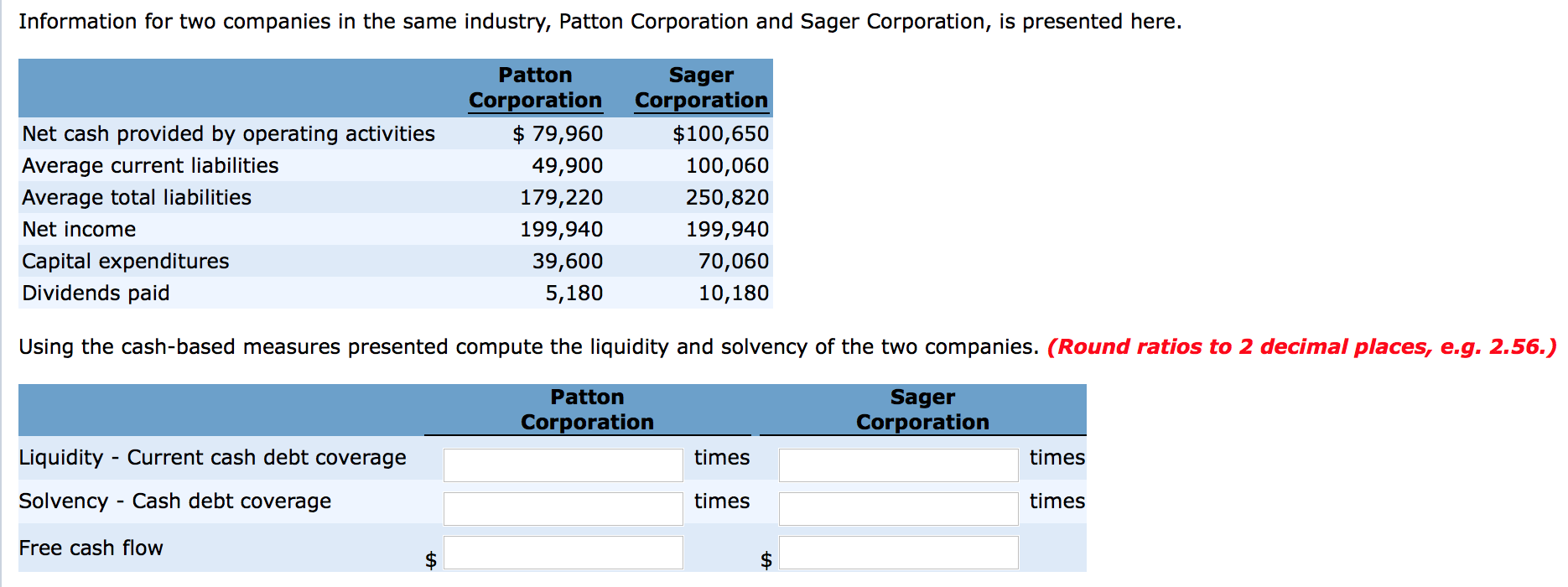

One of the main and you will lives-altering selection i create is to buy property, hence means much forethought and you can preparation. Its among the many assets we could build, each other financially and you can emotionally. As a result, someone uses a tad bit more than simply they meant to after they ran domestic search. Though construction fund are of help, it may be hard to build also a modest downpayment if you’re not economically separate, do not want risking your assets, or perhaps the property’s worthy of is truly highest. To purchase your most useful family, an unsecured loan could well be helpful in this case.

What exactly is a personal loan?

An individual or no-security financing is longer to help you a borrower to own strictly personal grounds. Typically, a debtor must introduce but a few pieces of papers to locate an unsecured loan. The pace is frequently more than a secured financing, eg a motor vehicle or a home. A personal loan can be utilized for purpose, and it may getting a good choice in a lot of varieties of gooey monetary factors.

The seller you should never wait or keep the possessions in the business having so long in the place of an existing arrangement. This is why, you need to identify almost every other types of funds that can be received towards short see. In terms of while making off repayments, the first choice is to apply for a personal loan.

Considering the less loan amounts, financial institutions easily agree and you can disburse signature loans. Bank card proprietors and you can users which have depending financial dating also can qualify for Instantaneous loans and also have the loans taken to its accounts within the a brief period of your energy.

Consumer loan acceptance featuring

In advance of approving a debtor to possess a personal bank loan, creditors can sometimes take into account the applicant’s creditworthiness and you may power to pay off the loan. However they read the the fresh borrower’s monetary history to see if otherwise not he has got a stable month-to-month money who would permit them and then make punctual payments of the equated month-to-month instalments.

Financial institutions promote personal loans without needing guarantee. As a result, the rate and that these firms costs is a lot higher whenever compared to that regarding house loans. But not, if a person features an excellent credit score, the rate can still be lowest.

In advance of investing in a consumer loan seller, individuals must do their search to find out who can render the most favourable rate of interest and you can repayment requirements. They should and additionally be aware that using an unsecured loan for an excellent advance payment will certainly reduce the amount of our home financing the bank is ready to add them for their quicker capabilities to settle the borrowed funds.

Unsecured loans is the best choice for resource this new down payment into the a home simply because they offer several advantages, some of which are listed below:

- Quick supply of finance

One of many brings away from a personal bank loan is the ease that it’s possible to get one. You can acquire a notification current email address regarding the bank when you has submitted a whole software with extremely important recommendations and you may records.

Brand new loan’s recognition or denial is dependent on the financial institution guaranteeing your information while the records you filed. After distribution all expected records, the loan recognition process will need 2-seven days. Yet not, this may include bank to help you lender. It might take a later date or two immediately following recognition toward finance to be released.

- Flexible repayment label

The loan period to have a consumer loan is generally anything from 12 months to help you five years, therefore the debtor is free of charge to determine the size that best serves their unique requires and you may repayment schedule.

- Zero equity

You to definitely biggest cheer out of an unsecured loan would be the fact, in place of almost every other secured loans particularly houses finance no credit check installment loans El Paso, car and truck loans, loans facing property, etcetera., you don’t need to created any very own property given that collateral. Additionally, good guarantor is not required to own an unsecured loan.

- Acts as an economic pillow

It’s also possible to sell assets otherwise acquire of household members or acquaintances whenever you prefer cash. For those who have a lengthy-label monetary approach, damaging the financing may possibly not be wise. Likewise, borrowing from the bank funds from family members can get strain dating. Plus, you need to have enough deals so you’re able to account fully for a rainy go out.

Drawbacks of employing an unsecured loan getting family

When it comes to being qualified to own a personal bank loan, you will find some drawbacks that you need to consider.

- High-interest rate

A premier-interest rate is the most significant drawback out of unsecured loans. Generally, the pace is just about a dozen 14% in line with the profile of the home consumer. A lengthier repay term, state 4 or 5 years, function you’ll pay a whole lot more appeal and costs compared to brand-new loan number.

The interest costs supplied by of a lot banks to attract 0.20 fee things only reduce users to 0.50 percentage products. Whether your monetary earlier in the day are pristine and your credit history is actually an excellent, you ought to apply this article for the best when haggling that have debt organization more than interest levels.

- Pre-necessary of a premier credit score

Loan providers out-of signature loans, such as for instance personal loans, believe a wide range of factors, as well as your credit history and you can records, many years, work condition, regular earnings and expense, etc, to choose the level of loan that you’re qualified to receive. Your credit rating was a major grounds when deciding your ability to make loan money. Loan companies will render borrowing for personal financing when they understand you really have a good financial history.

It entails strive to look for property that’s best in every ways. This is exactly a go you simply can’t manage to shun while the of a lack of funds to possess a good residence’s downpayment. Hence, HomeCapital has arrived that will help you with all of your downpayment conditions. HomeCapital will be based upon a straightforward but really powerful thought of fixing the critical problem of down-payment savings for homebuyers. We allow you to end up being a resident by giving desire-100 % free credit as much as 50% of the property down-payment count. No reason to take-out a costly personal loan. The program process is fast and simple to do on line. Knowing a little more about India’s basic family deposit direction system in order to speeds your property ownership hopes and dreams check out:

Offered to acquire a property?

Grab the first faltering step to home ownership which have HomeCapital, rating eligibility along with-principal sanction letter in one single time. Mouse click to get started.